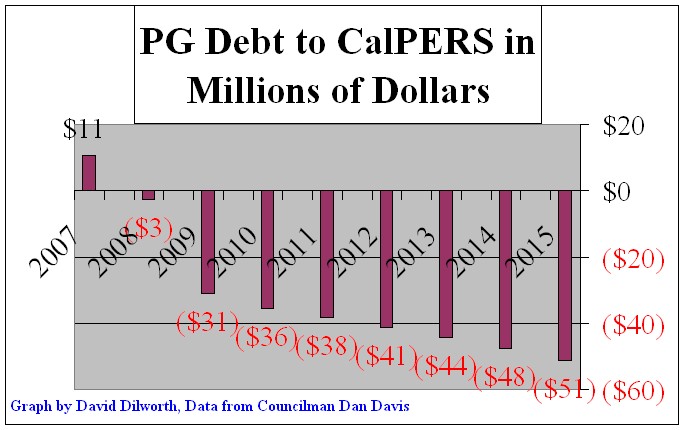

Here is a graph of the debt Pacific Grove residents are accumulating as a result of staying in CalPERs – contrary to the will of the voters.

The numbers from 2011 to 2015 are projections based on at least a 7.5 percent return on CalPERS investments.

If CalPERS fails to achieve 7.5 percent return (breathtakingly high these days) the debt will get even larger.

The data and notations are from Councilman Dan Davis who cites his references below (I just put it in a graph so you could see it easier.)

Total Assets on hand as of June, 2009: 69,487,590.00

Total Unfunded Liability for Pacific Grove Residents

2007 -$10.6 million

2008 – $2.6 million

2009 -$31 million

2010 -$35.6 million

The following are Projections:

2011 -$38.3 million

2012 -$41.2 million

2013 -$44.3 million

2014 -$47.6 million

2015 -$51.2 million

For context – Pacific Grove’s Annual Budget is less than $20 million.

Sources:

For 2007, 2008, 2009, 2010, Annual and Termination Evaluations for City of Pacific Grove, Sept, 2008, and May 2010, prepared by Barbara Ware, Senior Pension Actuary, CalPERS

For 2011, 2012, projections assuming a return and discount rate of 7.75%

For 2013, 2014, 2015, projections assuming a return and discount rate of 7.50%

Pacific Grove is on the road to ruin. The city manager will soon retire to a new city, with a nice pension and we will be left with big questions.

There are several questionable actions that need to be studied before he leaves. There was the 2002 pension increase that was possibly prohibited by Govt code 7507 and the debt limit, a million dollar per year raise that looks like it may have violated the debt limit, pension bonds that possibly violated the debt limit (and were a separate scandal), the costly fire merger, the 2009 deal with the POA to avoid a 10% salary reduction that was to take place in a few months, the trashing of the citizens pension reform, the questionable management of the pension law suit, ignoring the pension committee report and all of this information. You can’t make this stuff up.

What is happening in Detroit today, their bankruptcy, is exactly the direction that PG Is headed with one big exception. In Detroit all the people who could afford to pay more taxes have already left. In Pacific Grove we have a large base of residents who own property and who rent here . These are the people that the mayor and council majority will look to, to bail out their terrible decision not to overturn the illegal 2002 huge pension increase that was granted to some City employees.

Please, don’t be fooled by well-dressed, smiling and personable city leaders who are slowly destroying this town. It is up to the voters to insist that illegal 2002 pension increased be overturned.

So according to hard numbers Pacific Grove’s Pension debt grew to be twice the City’s total annual budget (40 million dollars) since 2008.

Twice the City’s annual budget – for Pension payments alone !

And that is based on the retirement fund (CalPERS) getting a 7.5% rate of return on their investments.

This means the $40 million projection (as of today) is ridiculously conservative (no rational person believes CalPers will get 7.5% rate of return anytime in the near future). This also indicates that every 5 years from now on the Pension debt again grows larger than the city’s entire budget !

Using reasonable projections (like CalPers getting 1-2% interest) – the City’s Pension debt will exceed the City Budget every 2 years from now on. The Pension debt will double every 6 years – or less.

This is so far beyond fiscal insanity it is hard to express in words.